The copyright market is notorious for its wild swings. Prices can plummet in the blink of an eye, leaving even the most seasoned traders feeling unsettled. But for those who truly believe in the promise of cryptocurrencies, these price swings are merely opportunities to accumulate. It's a mental game, and mastering it requires determination. A true HODLer understands that quick profits are irrelevant. The focus is on the long-term strategy: building wealth through patient investing.

- Don't forget that you acquired your copyright because you believe in its underlying technology.

- Don't give in to fear during market downturns.

- Stay informed on the projects you're invested in.

- And above all, HODL strong.

DeFi Deep Dive: Exploring Decentralized Finance

Decentralized finance copyright, or DeFi, is revolutionizing the marketplace landscape by leveraging blockchain technology to offer transparent and available financial services. Unlike traditional finance, DeFi operates on a peer-to-peer system, minimizing the need for intermediaries like banks and financial institutions. This disruptive innovation empowers users with greater autonomy over their holdings.

DeFi encompasses a diverse range of applications, encompassing lending and borrowing platforms, decentralized exchanges, stablecoins, yield farming protocols, and more. These cutting-edge solutions are transforming various aspects of finance, from transfers to wealth creation.

The promise of DeFi is vast, with the ability to empower individuals by providing financial inclusion for all. However, it's important to acknowledge the inherent risks associated with this emerging space, such as smart contract vulnerabilities and market volatility.

Navigating copyright Trading Strategies for Beginners

Diving into the volatile world of copyright trading can seem challenging, especially for beginners. However, with a clear understanding of basic strategies and disciplined practice, you can reduce risk and increase your chances of success. A crucial first step is to completely research different cryptocurrencies, analyzing their technology. It's also critical to develop a well-defined trading plan that outlines your appetite for risk, investment goals, and purchase and selling strategies.

- Exploiting technical analysis tools like charts and indicators can provide valuable insights into price trends and likely market movements.

- Spreading your portfolio across multiple cryptocurrencies can help reduce the impact of any single asset's performance.

- Dollar-cost averaging involves investing a fixed amount of money at regular intervals, which helps average price volatility over time.

Remember, copyright trading involves inherent risks, and it's important to trade cautiously. Continuously learn your knowledge, stay informed of market trends, and modify your strategies as needed.

Unlocking the Potential of Altcoins

The copyright/digital/blockchain landscape is constantly evolving/expanding/transforming, with emerging/novel/innovative cryptocurrencies continuously/frequently/regularly pushing the boundaries/limits/frontiers of what's possible. Altcoins, as they are commonly/widely/universally known, offer a diverse/varied/extensive range of use cases/applications/purposes beyond traditional/established/conventional payment systems/methods/platforms. From decentralized finance/stablecoins/tokenized assets, to NFTs/gaming/metaverse, altcoins have the potential to revolutionize/disrupt/transform numerous industries/sectors/domains.

- Investors are increasingly recognizing/appreciating/acknowledging the value/potential/opportunity of altcoins, leading to a surge/boom/explosion in adoption/investment/interest.

- However/Despite this/Though, navigating the complex/volatile/unpredictable world of altcoins can be challenging/difficult/tricky for even the most experienced/seasoned/savvy investors.

Therefore, it's crucial to conduct thorough research/due diligence/analysis before investing/participating/diving in.

From Fiat to copyright

Stepping into the realm of cryptocurrencies here can feel overwhelming, like a labyrinth. But fret not! This beginner's guide will unveil the essentials, helping you navigate the transition leaving behind fiat for copyright. We'll delve into the fundamental concepts, explore popular cryptocurrencies, and empower you with knowledge to make informed decisions.

- Initially, let's understand what cryptocurrencies are and how they work.

- ,then we'll dive into the world of blockchain technology, the foundation of all cryptocurrencies.

- Finally, we'll exploreways to obtain cryptocurrencies and secure them safely.

Get ready to embark on an exciting adventure into the world of copyright!

Deciphering copyright's Impact on Finance

As advancements rapidly evolves, notions of money are undergoing a substantial transformation. copyright, a digital form of currency, is emerging as a leading player in this evolving landscape. Grasping the fundamentals of copyright is crucial for navigating to the rapidly changing financial world.

- Blockchain technology, the core of most cryptocurrencies, facilitates secure and transparent movements without the need for a central bank.

- Bitcoin, the first copyright, achieved recognition as a investment and a means of payment.

- Altcoins, or alternative cryptocurrencies, appear offering diverse functionalities.

However, in light of its price swings, copyright remains a controversial topic. Regulatory frameworks are still evolving to address the risks and rewards posed by this novel financial instrument.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Ralph Macchio Then & Now!

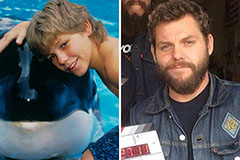

Ralph Macchio Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!